The Facts About Insurance Agency In Dallas Tx Revealed

If you have any kind of concerns about insurance, contact us and also request a quote. They can aid you pick the best plan for your demands. Call us today if you want personalized solution from a certified insurance policy representative - Truck insurance in Dallas TX.

Below are a couple of reasons that term life insurance policy is the most popular kind. It is economical. The price of term life insurance coverage costs is established based upon your age, health, and the protection quantity you need. Specific types of organization insurance policy may be lawfully compulsory in some circumstances.

HMO plans have lower month-to-month premiums as well as reduced out-of-pocket expenses. With PPO strategies, you pay higher month-to-month premiums for the freedom to make use of both in-network and out-of-network service providers without a reference. PPO plans can lead to greater out-of-pocket medical costs. Paying a costs resembles making a month-to-month vehicle settlement.

Commercial Insurance In Dallas Tx Fundamentals Explained

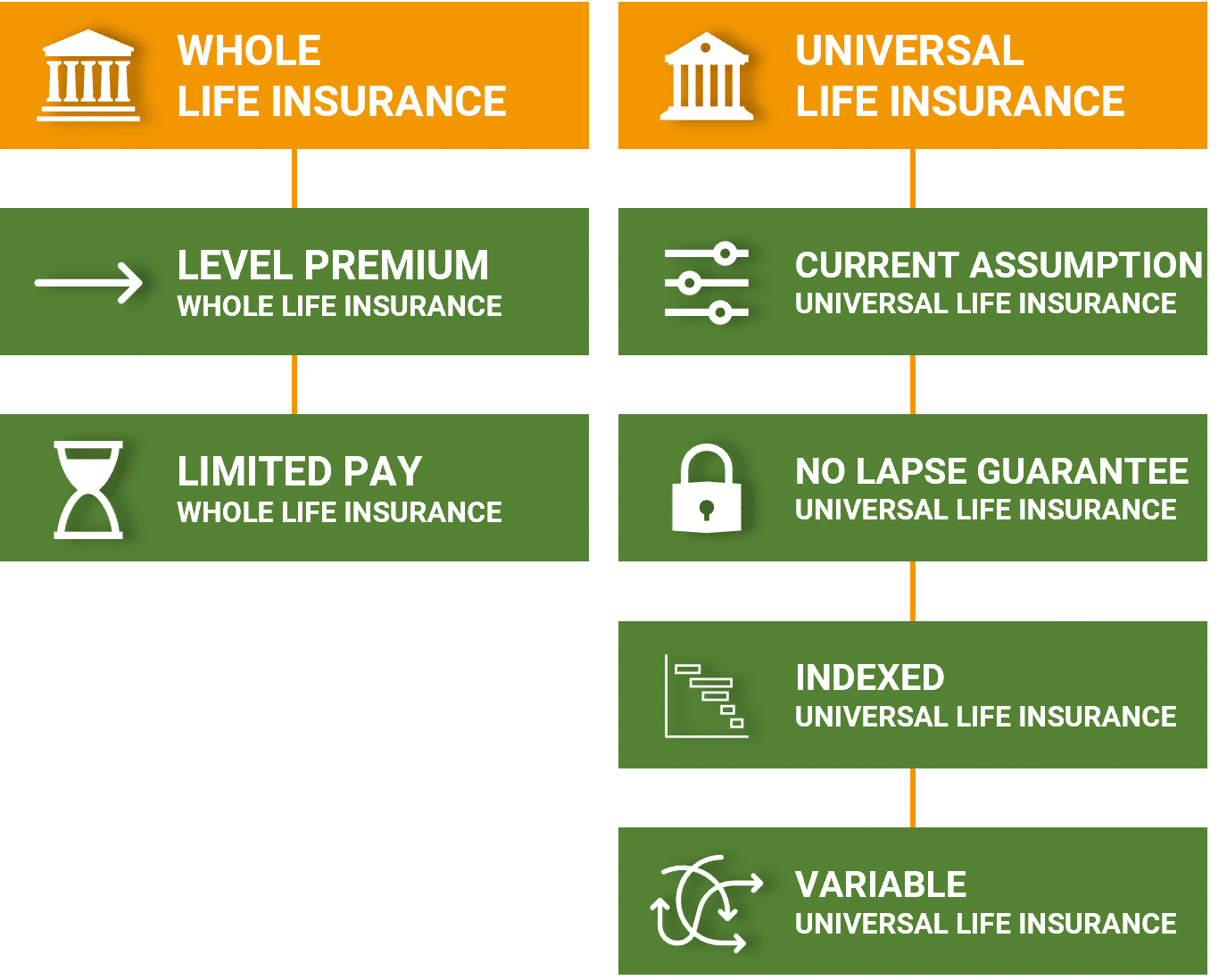

When you have an insurance deductible, you are liable for paying a certain amount for protection solutions prior to your wellness strategy gives insurance coverage. Life insurance policy can be divided into two main kinds: term as well as permanent. Term life insurance policy supplies protection for a particular duration, normally 10 to 30 years, as well as is more affordable.

We can not avoid the unexpected from happening, however occasionally we can protect ourselves as well as our households from the worst of the economic fallout. Four types of insurance coverage that many monetary specialists advise consist of life, health and wellness, vehicle, and long-term impairment.

It includes a fatality advantage as well as likewise a money worth element.

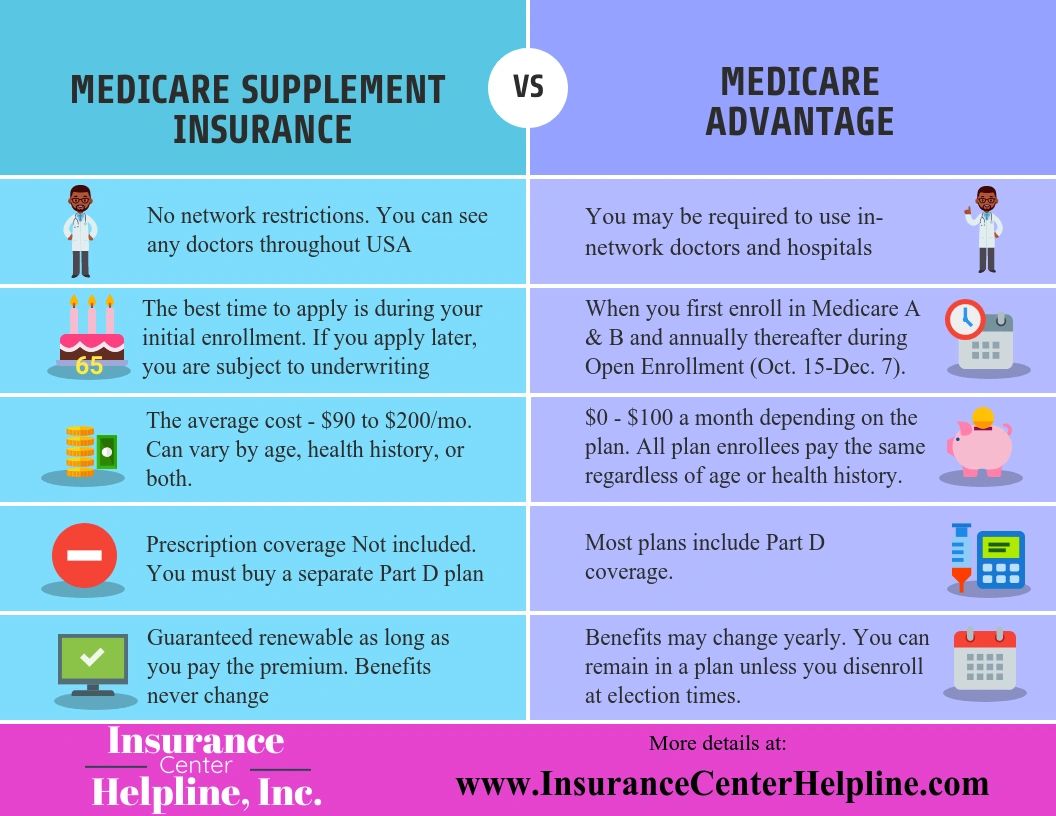

2% of the American population was without insurance coverage in 2021, the Centers for Condition Control (CDC) reported in its National Facility for Wellness Data. Greater than 60% obtained their protection through an employer or in the private insurance industry while the remainder were covered by government-subsidized programs including Medicare and Medicaid, veterans' advantages programs, as well as the government marketplace developed under the Affordable Treatment Act.

What Does Health Insurance In Dallas Tx Do?

According to the Social Security Administration, one in 4 workers entering the labor force will come to be disabled prior to they get to the age of retirement. While health and wellness insurance pays for hospitalization as well as clinical bills, you are typically strained with all of the costs that your income had actually covered.

:max_bytes(150000):strip_icc()/4-types-of-insurance-everyone-needs.aspx-final-f954e12eb3074b178e4b53a882729526.jpg)

Nearly all states require drivers to have car insurance coverage and also the few that do not still hold motorists economically in charge of any damage or injuries they trigger. Below are your choices when purchasing auto insurance policy: Obligation insurance coverage: Pays for residential or commercial property damage and injuries you create to others if you're at mistake for a crash and likewise covers lawsuits expenses as well as judgments website here or negotiations more info here if you're filed a claim against due to a vehicle mishap.

Company coverage is often the most effective alternative, but if that is not available, get quotes from several service providers as many offer price cuts if you purchase more than one sort of insurance coverage.

The 10-Second Trick For Home Insurance In Dallas Tx

The best plan for you will certainly depend on your personal conditions, just how much insurance coverage you need, as well as just how much you intend to pay for it. This overview covers the most usual sorts of life insurance policy plans on the market, consisting of information on just how they function, their benefits and drawbacks, how long they last, and also that they're best for.

This is the most popular type of life my sources insurance coverage for a lot of people because it's economical, just lasts for as long as you require it, and comes with few tax policies and constraints. Term life insurance policy is one of the simplest and cheapest methods to give a monetary safeguard for your enjoyed ones.

You pay premiums towards the plan, and if you die throughout the term, the insurer pays a set quantity of cash, called the survivor benefit, to your designated beneficiaries. The fatality advantage can be paid as a swelling amount or an annuity. Many people choose to receive the fatality advantage as a round figure to prevent paying tax obligations on any type of made rate of interest. Insurance agency in Dallas TX.